The Inland Revenue Board of Malaysia (LHDN) confirmed that income generated from reviews, brand endorsements and social media promotion are subject to income tax.

Since many bloggers and freelancers earn money from these activities, I thought it would be useful to have some accounting professionals answer some frequently-asked questions about taxes:

Do you need to pay income tax if you are a blogger?

Do Malaysian bloggers / freelancers need to register a business?

How do I record my income from Google AdSense / ad networks?

How much of my “income” is taxable?

In February 2019, two accounting professionals spoke to members of the Kuala Lumpur WordPress Meetup about this topic. Here are pictures and slides from the seminar. I want to give a warm thank you to:

Winnie Chua, principal of SNC Consultants Sdn Bhd

[email protected]

Rosdelima Mohd Ali Jaafar, partner at Rosdelima & Co

[email protected]

This article is a summary of their presentations at the event.

Bloggers are subject to income tax

Yes you must file your income tax. And you must pay taxes if your annual income exceed RM34,000 a year (as per 2018 guidelines). The good news is that you only pay taxes on your chargeable income, which is your total annual income minus all the tax reliefs and exemptions that Malaysians residents are entitled to.

Rosdelima gave an example of how someone with a RM54,000 net profit / income could reduce their chargeable income with some basic tax reliefs (life insurance, children & dependents, etc). After claiming tax reliefs and deductions, this person pays only about RM80 in taxes.

This is where it’s a good idea to hire an accountant or a tax agent, who can help you with bookkeeping, identify ways to reduce your chargeable income and even file your tax return.

Takeaway: Pay less in taxes by claiming all the tax reliefs and exemptions that you can to lower your chargeable income

What about the income I earned last year?

If the income from your business last year exceeds the RM34,000 threshold, you should take advantage of the ongoing Special Program for Voluntary Disclosure. Failure to declare and pay your past taxes may cost you a hefty 80-300% in penalty, so do take advantage of it before the programme ends.

Register a sole proprietorship immediately

If you haven’t yet done so, you should register a business immediately with SSM. A sole proprietorship (sole prop) is ideal business structure for most bloggers and freelancers. You can register as a sole prop using a personal name or using a trade name (recommended).Learn more about sole proprietorships

The biggest benefit of having a business are tax deductions. You can identify certain expenses as operating expenses which can then reduce your net income, thus reducing the amount of tax you need to pay. For example, your bills for Adobe Creative Cloud, web hosting, website design, and equipment like cameras, microphones and computers could be classified and deducted as operating expenses.

Another really important practical benefit is signing up for a business bank account. This will allow you to separate your business finances from your personal finances, making your bookkeeping, accounting and filing taxes a lot easier.

Maybank has a SME First Account that gives you online banking, ability to apply for business credit cards and POS systems. The minimum deposit is RM1,000.

If you feel that it’s not necessary to have a business bank account, then you should at least have a separate bank account so that you can easily identify your freelance income and expenses.

What if I’m already employed full time?

You should still register a business if you’re already employed full time. You might think you don’t need it since you already have a personal tax file, but you’ll miss out on the tax deductions. And real talk – of course you want to have your business pay for your gadgets and other “business expenses”. If you pay for your expenses with a personal credit card, you’ll earn credit card points on top of getting a tax deduction.

By the way, your taxable income is the sum of both your full-time employment and business income (minus tax reliefs and deductions).

Takeaway: Register a sole proprietorship with SSM immediately.

Further reading: How to Register a Company with SSM (Step-by-step Guide)

Bookkeeping aka Recording accounting transactions

Accurate bookkeeping is essential to correctly declare your taxes. Declaring the wrong income and paying the wrong amount of taxes will get you into trouble, opening yourself up to audit and possibly fines and jail time.

It’s not enough to record your income and expenses, you need a paper trail as proof. And you need to keep the “source documents” for 7 years in case you are audited by LHDN.

File away your source documents

Here are a list of documents you should file away for safekeeping.

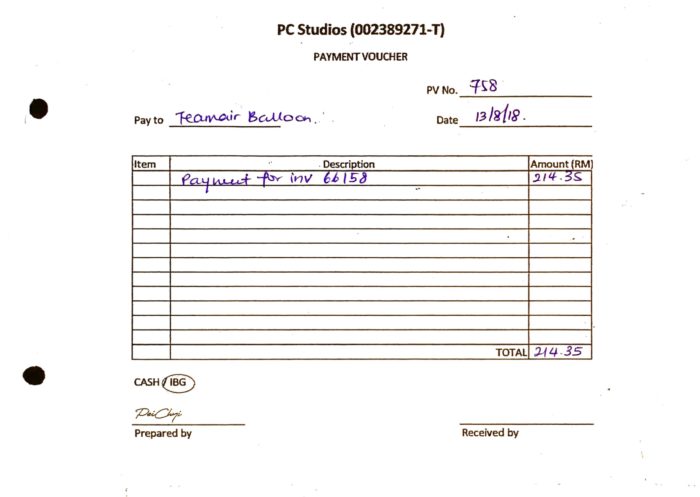

Money in – Invoices and sales receipts for income that you have received. An invoice is a document that tells the customer how much they owe you and for what. Sales receipts are documents issued when payment is received immediately upon rendering the service.

Money out – Invoices, bills and receipts for any expenses you incur. Additionally you can use payment vouchers to record expense payments without bills.

Statements from your bank account, payment processor / gateway showing the transactions in and out. Or if you’re paid from a middleman service e.g. Google AdSense, Etsy, Lazada, etc be sure to print out / download your monthly statements too.

Record and organize your transactions

This is the most difficult part of the accounting process in my opinion. There are lots of terms that we don’t understand, and things must be done in a certain way. Accounting professionals reading this – basic bookkeeping workshops and trainings would be invaluable.

Your income and expense must be recorded and categorized into different accounts. We didn’t talk about this at the seminar, but I know many business owners who would want to know about some standard accounts you should keep track of.

Asset Accounts

- Cash / Bank Accounts – cash on hand

- Accounts Receivable – unpaid invoices

- Inventory – the stock you have on hand for sale

- Equipment – computers, cameras, etc used in your business

Equity Accounts

- Opening Balance Equity – existing cash in your bank accounts

- Owner’s Draw / Drawings – money that you take out from the business for living and personal expenses

Revenue (Income) Accounts

- Sale of Products

- Sale of Services

Expense Accounts

- Supplies

- Salaries / Wages

- Advertising & Marketing

A quick note that expense accounts are different for each business. If you’re a blogger, “Baking Ingredients” are not an expense, but they would be for bakers and cooks. This would also count as a “Cost of Goods Sold” expense. See this article on the list of accounts in a business.

While you can do your bookkeeping (record your transactions) with Excel or Google Sheets, I strongly recommend using dedicated software like Wave Accounting (free) or Quickbooks (starting at RM53.00 per month). Xero is another paid option. And I’ve just learnt about Financio, which is cloud accounting software by a local company (starts at RM0)

These apps are designed for business owners (not accountants) so bookkeeping takes a back seat. Instead of asking you to credit Accounts Receivable and debit the customer’s account, you simply have to create an invoice. This makes things easier for non-accountants like us.

I use Quickbooks and my wife uses Wave Accounting so I have experience with both. I think Quickbooks is definitely worth the fee because it has more features, is easier to use and has support and FAQs built in directly into the app. It can also import your bank transactions from Maybank so you save time keying them in manually.

Tip: There is no “correct way” of bookkeeping. Instead, every accountant has their own preferences and methods. The goal is to ensure all the numbers tally.As long as you’ve got that, don’t stress that you’re not doing it correctly.

Takeaway: Spend some time learning about bookkeeping or hire an accountant to help you. Using accounting software will make it easier to “keep your books in order”.

Like I said, bookkeeping is probably the hardest part of the process. But you don’t have to do it alone…

Hire an accountant or bookkeeper

Most bloggers and small businesses should just hire someone to help with their bookkeeping and taxes. It’s a cost of doing business (which you can also categorize as a business expense).

There are 2 main ways to work with an accountant:

Bookkeeping

This is where you send your accountant all your invoices, statements and receipts (that you have organized neatly) and they will record all your transactions into your accounting software of choice.

How much does this cost? That will depend on how much time the accountant needs to do the work, so help reduce the time spent by being as neat and organized as possible. I’d expect to pay about RM1200 for a whole year of bookkeeping.

Tip: Pay your accountant do 1 year of bookkeeping then learn how to do it yourself next year to save cost.

Tax Filing

When it is time to file your tax return, your accountant can generate the balance sheet and profit & loss statement for your business to check for any errors in bookkeeping, and then calculate your business’ net profit (income). They will then help you claim any tax reliefs, deductions and exemptions so you pay less tax. Finally they can help file the tax return and calculate the amount you need to pay. The cost starts from RM650 per year.

Where to find accountants

In addition to Winnie and Rosdelima, you can also try these:

QuickBooks ProAdvisors in Malaysia

Hiring an accounting professional will help ensure that you fulfil your tax obligations correctly and avoid having to deal with LHDN. You may not like to do it, but it’s better than having to pay more tax than necessary, being blocked from getting a car/home loan or worse, getting an audit request from LHDN.

Learn more about Accounting

Here are some resources to learn further about accounting and bookkeeping:

Dave Marshall’s free Bookkeeping Course

Quickbooks Online – The Big Picture. While it references Quickbooks, these series of videos and articles explain a lot of what you need to know in simple language.

Join the Kuala Lumpur WordPress Meetup. It’s totally free and is a great way to meet fellow bloggers and business owners who face the same issues as you. Plus we may do another session on accounting and bookkeeping too.

A big thanks to Suraya of RinggitOhRinggit for helping me proof-read and edit this article. Check out her Beginner-Friendly Tax Guide for Online Businesses in Malaysia and her first published book: Money Stories from Malaysians: Volume 1.

Hi David, thanks for the effort in organising the event and also posting this info on your blog. It really helps me to understand what are the things needed to have in order to run a small businesses (and not escaping the Lembaga)…. and this is all for the extra income for my kids education needs. Bravo David….. btw I watched the movie and that is really “bad ass!”

You’re welcome Nazlan. Glad to know our events are useful and thanks for attending too. See you at the next meetup 🙂

there is an easier way to calculate the tax you need to pay now! just enter your details and get results instantly @ https://www.tupaicukai.com.

Super useful for those who are in the digital space. Can’t agree much on how hiring an accountant can make your life much easier.

Can you minus 100% of your relevant expenses from your income? Or just a certain percentage? Would love to find out more about deducting expenses for income tax as a freelancer/sole prop!